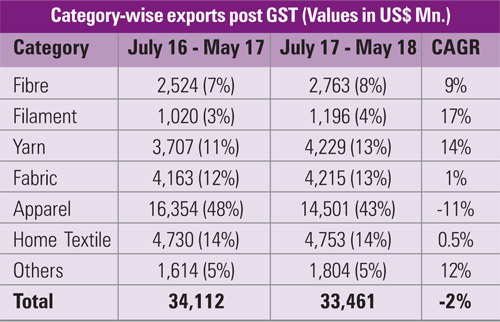

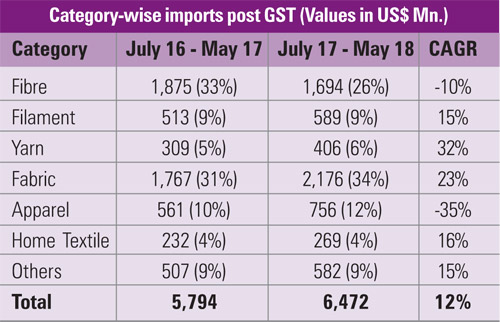

The Indian textiles and apparel sector continues to be bedevilled by one problem or another. The introduction of the Goods and Services Tax (GST) was supposed to bring in more relief to the industry. Far from it, one year of completion of GST has been a significant growth in imports of all value-added products – yarn, fabrics, garments and home textiles – and a steep fall in exports creating a big issue for the domestic industry with the customs duties coming down substantially. This has made imports cheaper by about 15-20 per cent Post- GST, countervailing duties (CVD) and Special Additional Duties (SAD) were withdrawn and Integrated GST. This has left textile manufacturers and exporters wanting for more.

Imports of textile products have been rising from our neighbouring countries such as China, Bangladesh, Sri Lanka, Indonesia, Thailand etc., The Free Trade Agreements (FTAs) with Sri Lanka and Bangladesh have made the situation worse as other countries route their textile products, duty-free, through them as India has no rules of origin in place.

Moreover, India does not have major FTAs with large importers of textiles and apparel, unlike other manufacturing Asian countries. Pakistan, Bangladesh, Indonesia and Vietnam enjoy special access to a few major markets across the world duty-free. Fabrics can be exported duty free from Pakistan to China, while Indian fabrics attract a 10 per cent customs duty.

India has trade agreements with South Korea, Japan, Bangladesh and a few other neighbouring countries. But the effect on textiles and apparel is not significant. Talks are on for FTAs with Britain, Australia and the US, and New Delhi may consider including textiles and apparel in the negotiations to impart competitiveness to the Indian manufacturers.

Needless to say, India should take forward negotiations for concluding the India-European Comprehensive Free Trade Agreement, which will bring in a lot of relief to our textile sector and enable the manufacturers to compete effectively with Bangladesh.

It is strongly felt that a firm decision needs to be taken to refund accumulated credit on account of inverted duty structure to fabrics manufacturers in particular as this segment is already facing a lot of difficulties due to GST and while competing with its counterparts in the global market. As for the overall growth of the textiles sector, fabrics plays an important role and it also generate job opportunities – around 30 to 50 jobs on the one cr investment.

The Indian textiles and apparel market is currently worth $127 bn, of which about 70 per cent is consumed locally and the remaining 30 per cent is exported. The sector has solidified its position as the second largest exporter of textiles and apparel with a 5 per cent share in the $750 bn global market. The industry is at a very important threshold from where it can move to higher growth trajectory. China, which has more than a 35 per cent share in the global trade of textiles and apparel is in the process of shifting its focus from exports to the domestic market has opened avenues for India to take up its share and strengthen its position in the global textiles and apparel trade. However, some countries such as Bangladesh, Vietnam, Myanmar and Cambodia are emerging very fast and some have already overtaken us in the apparel trade. Some urgent steps are therefore required for the industry to achieve the desired growth. These include framing a special package in the form of Refund Of State Levies (ROSL) to all the segments including yarn and fabrics.

The Indian textiles and apparel market is currently worth $127 bn, of which about 70 per cent is consumed locally and the remaining 30 per cent is exported. The sector has solidified its position as the second largest exporter of textiles and apparel with a 5 per cent share in the $750 bn global market. The industry is at a very important threshold from where it can move to higher growth trajectory. China, which has more than a 35 per cent share in the global trade of textiles and apparel is in the process of shifting its focus from exports to the domestic market has opened avenues for India to take up its share and strengthen its position in the global textiles and apparel trade. However, some countries such as Bangladesh, Vietnam, Myanmar and Cambodia are emerging very fast and some have already overtaken us in the apparel trade. Some urgent steps are therefore required for the industry to achieve the desired growth. These include framing a special package in the form of Refund Of State Levies (ROSL) to all the segments including yarn and fabrics.

Also, there is a need to extend the benefits under the Merchandise India Export Scheme (MEIS) to cotton yarn and increase MEIS on fabrics from two to four percent. This is because the industry’s export competitiveness is getting completely eroded by the embedded taxes that on exporter pays to the State Government and the Central Government in the form of electricity cess, fuel surcharge, Krishi Kalyancess etc., besides, the government must consider releasing pending subsidy under the Textile Upgradation Fund Scheme (TUFS).

Also, there is a need to extend the benefits under the Merchandise India Export Scheme (MEIS) to cotton yarn and increase MEIS on fabrics from two to four percent. This is because the industry’s export competitiveness is getting completely eroded by the embedded taxes that on exporter pays to the State Government and the Central Government in the form of electricity cess, fuel surcharge, Krishi Kalyancess etc., besides, the government must consider releasing pending subsidy under the Textile Upgradation Fund Scheme (TUFS).

Moreover, the inverted duty structure in respect of manmade fabric (MMF) textiles has led to blockage of working capital. There is need to remove this anomaly by reducing GST on man-made fibres from 18 per cent to 12 per cent and on man-made yarn from 12 per cent to 5 per cent. There are talks that the government is considering merging the current 12 per cent and 18 per cent on several items. Whether the merge will lead to a reduction in the rates of man-made fibre and man-made yarn remains to be seen.

MMFs account for just 25 per cent share of consumption compared to their share of 70 per cent globally. The last five years have seen a decrease while cotton has maintained its position over 70 per cent. Going forward, due to supply slide pressure and price volatility, cotton may struggle to satisfy growing demands which in turn will increase consumption of man-made fibres in India.

India has the largest number of looms in place to weave fabrics, accounting for 64 per cent of the globally installed looms. The organised looms contribute only 5 per cent to total production while the decentralized powerloom section produce three –fourths of the total woven fabrics. With an annual production of 47 mn sq. mtr, India is among the world’s leaders in woven fabric manufacturing.

India has, over the years, been a net exporter of textiles and clothing with exports reaching over dollar 36.7 bn in 2017-18. Apparel is the largest category exported from the country, with a share of 46 per cent of the total textile and apparel exports. Apparel exports had risen from $15 bn in 2013-14 to $17.5 bn in 2016-17.

As regards the raw material scenario, CITI Economic Desk notes that cotton is the most abundant material and accounts for about 73 per cent of the total fibre consumption in the country. Cotton is cultivated on more than 37 per cent of the total available land which has enabled to the country to become the largest manufacturer as well as exporter of cotton in the world. The overall production of natural fibres has seen a minor decline in the last five years owing to lower demand, increasing imports and substitution by man-made fibres (MMFs).

As regards the raw material scenario, CITI Economic Desk notes that cotton is the most abundant material and accounts for about 73 per cent of the total fibre consumption in the country. Cotton is cultivated on more than 37 per cent of the total available land which has enabled to the country to become the largest manufacturer as well as exporter of cotton in the world. The overall production of natural fibres has seen a minor decline in the last five years owing to lower demand, increasing imports and substitution by man-made fibres (MMFs).

Next to spinning, India has the largest number of looms to weave fabrics, accounting for 64 per cent of the globally installed looms. India’s weaving sector comprises 3 distinct segments – organised mills, powerlooms and handlooms.

The organised sector contributes only 5 per cent to the total production. On the other hand the decentralized powerlooms produce three-fourths of the total woven fabrics. India has an annual production of 47 bn sq. mtr and is among the world leaders in woven fabric production. There has been a significant liberal government policy for the powerlooms. This has helped woven fabric exports to increase to $4.6 bn in 2017-18.

The knitting sector, however, is at an infant stage. It contributes just one percent to the global knit fabric trade compared to over China’s 50 per cent share in the same segment. One of the major reasons for this is the lack of knitting mills. Thus, most knit fabrics is produced in small decentralised mill. Knit production touched around 17.5 bn sq.mtr which when compared to woven fabrics accounts for just 27 per cent of the total fabric production in 2017-18.

The production of cotton and blended fabrics has seen a reasonable growth in the last few years. However, hundred per cent non-cotton fabrics have shown a slight decline in the last two years. Needless to say, processing is the segment in the textile value chain where India lacks the most. Though there is sufficient manufacturing capacity, there is lack of large composite mills with the State-of-the-art technology and requisite skills to manufacture fabrics. This is the key area of production which determines the strength of the textile value chain.

Garmenting in India is highly fragmented and nearly 90 per cent of manufacturing units are part of the small and medium enterprise (SMEs) category. However, they lack high level of productivity compared to manufacturing systems applied in neighbouring countries such as Bangladesh, Indonesia and China.